ev tax credit bill date

The bill would create an electric bike tax credit a 30 credit for commercial electric vehicles and a 4000 used EV tax credit. All-electric and plug-in hybrid vehicles bought new in or after 2010 may be eligible for a 7500 federal income tax credit.

Road Tax Company Tax Benefits On Electric Cars Edf

All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7500.

. The federal EV tax credit may go up to 12500 EV tax credit for new electric vehicles. Most Tesla cars sold starting on January 1 2022 would be eligible for an 8000 or 10000 credit. Create an additional 2500 credit for assembled in the US.

Under the bill individual taxpayers reporting adjusted gross incomes of 250000 or 500000 for joint filers to get the new EV tax credit. The new system is designed to encourage consumers to buy electric cars and incentivise companies to utilise union workers in the United States. The amount of the credit will vary depending on the capacity of the battery used to power the car.

The full EV tax credit will be available to individuals reporting adjusted gross incomes of 250000 or less 500000 for joint filers decreased from 400000 for individuals800000 for joint. The Build Back Better bill includes a 12500 EV tax credit up from the current 7500 available to qualifying cars and buyers. This bill modifies and extends tax credits for electric cars and alternative motor vehicles.

Place an 80000 price cap on eligible EVs. The latest proposal involves up to a 12500 EV tax credit an increase from the current 7500 EV credit but with a number of potential changes. This credit includes both the 7500 main credit plus another 500 for Tesla cars with American-made batteries House version or another 2500 Senate.

An EV with at least a 5 kWh battery capacity can snag you another 417 plus another 417 for each kWh above that 5 kWh threshold. The effective date for this is after December 31 2021. But this is a flat credit which means it is only worth the full 7500 if the individuals tax bill is at least 7500.

State and municipal tax breaks may also be available. The policy allows taxpayers to get credits of up to 7500 for the purchase of electric-powered vehicles provided individuals owed at least that much in taxes that year. We are currently updating sales estimates through December 31 2021 for the automakers.

Create an additional 2500 credit for union-made EV. The current tax credit has a base of 2500 and is replaced with a new 4000 base credit as long as the EV has a battery of at least 10 kWh and can be plugged in and recharged. State andor local incentives may also apply.

The second document made further changes. The thing this didnt mention is that at least in one of the versions of the revised EV tax credit that is part of the 35T bill there was already an. In addition the bill modifies the credit to.

Based on our recent estimates and forecast Toyota will be the next manufacturer to reach the 200000 tax credit phaseout threshold. If you purchased a Nissan Leaf and your tax bill was 5000 that. If the Build Back Better bill passes both the House and Senate it will make the EV tax credit refundable which would put at least 4000 and up to 12000 back in buyers pockets.

EVAdoption will update our Federal EV tax credit phase-out tracker a few times per year so check back on a regular basis. The credit amount will vary based on the capacity of the battery used to power the vehicle. The new EV tax credit would be worth up to 12500.

A Brief Overview of the Current EV Tax Credit On October 3 2008 then-president George Bush signed HR. Current EV tax credits top out at 7500. Increasing the base credit amount to 4000 from 2500 is fine.

If an EV buyer has a tax bill of say 3000 at the end of the year the EV tax credit can only be a maximum of 3000. Many EVs these days have a 100 kWh battery which would easily max out that 7500 credit. After his signing it became Public Law 110-343 which included the Energy.

Congress is mulling over passing the Build Back Better Act which would increase the maximum electric vehicle tax credit to 12500 in 2022. A tax credit means an EV buyer will receive up to a 7500 reduction in their tax liability for the year. The bill extends the tax credit for new qualified plug-in electric drive motor vehicles through 2031.

Even an EV with a much smaller battery capacity say 16 kWh would max out the tax credit. A refundable tax credit is not a point of purchase rebate. Small neighborhood electric vehicles do not qualify for this credit but.

Despite the passage of the Biden administrations long-awaited infrastructure bill a potential expansion of the EV tax credit remains on hold as part of the separate Build Back Better Act. Remove the limitation on the number of vehicles per manufacturer that are eligible for the credit. The policy also set a cap.

The renewal of an EV tax credit for Tesla provides new opportunities for growth.

Electric Vehicle Tax Credit For 2022 The Complete Guide Leafscore

Ev Ev Charger Incentives In Europe A Complete Guide For Businesses Individuals

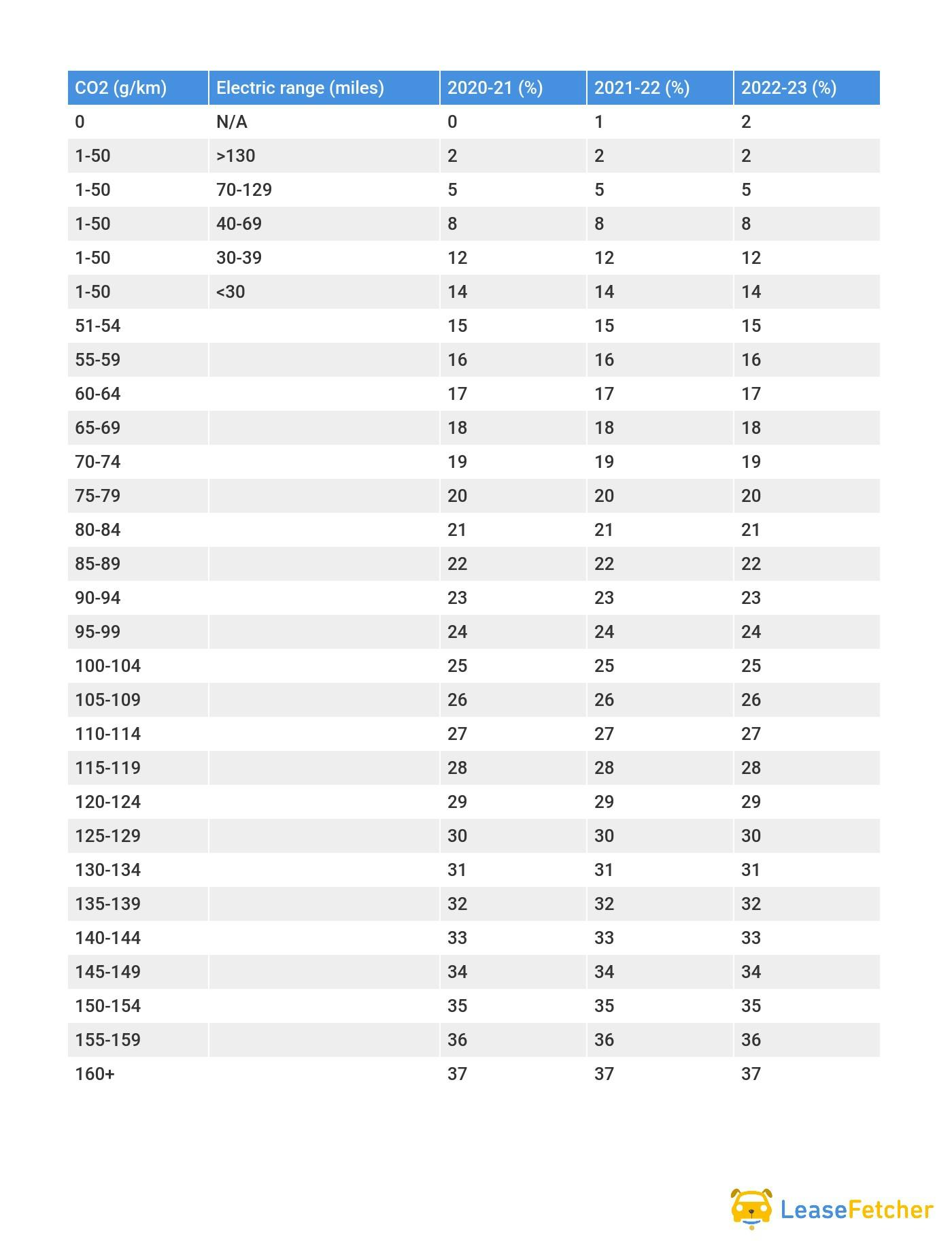

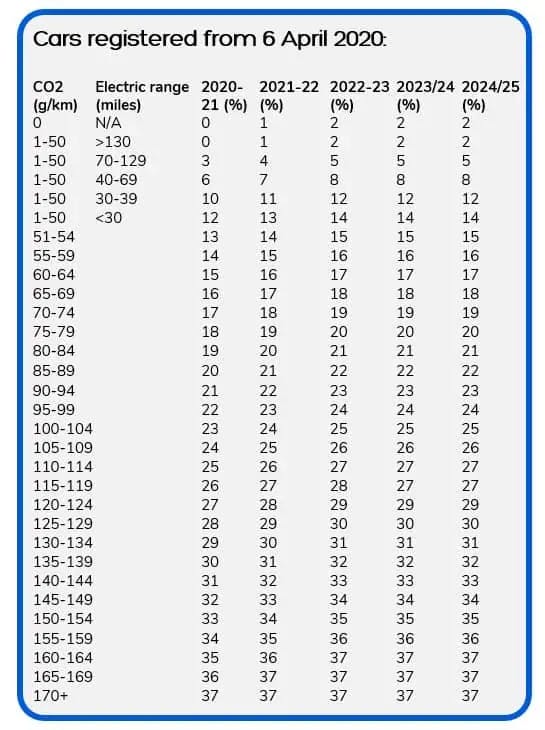

Company Car Tax On Electric Cars How Much Do You Pay Lease Fetcher

A Bigger Tax Credit For Going Electric What It Could Mean For Consumers Forbes Wheels

Electric Company Car Tax Explained Guides Driveelectric

Road Tax Company Tax Benefits On Electric Cars Edf

Ev Tax Credits Manchin A No On Build Back Better Bill Putting 12 500 Incentive In Doubt Cnet

Latest On Tesla Ev Tax Credit March 2022

Latest On Tesla Ev Tax Credit March 2022

Ev Tax Credits Manchin A No On Build Back Better Bill Putting 12 500 Incentive In Doubt Cnet

A Bigger Tax Credit For Going Electric What It Could Mean For Consumers Forbes Wheels

The Tax Benefits Of Electric Vehicles Saffery Champness

How Electric Vehicle Tax Credits Work

Understanding Federal Tax Credits For Electric Cars Capital One

The 12 500 Ev Tax Credit 2022 Everything You Need To Know Updated Yaa

These 5 Plugin Vehicle Models Would Benefit Most From Proposed Us Ev Tax Credit Update Chart Cleantechnica

Road Tax Company Tax Benefits On Electric Cars Edf

A Bigger Tax Credit For Going Electric What It Could Mean For Consumers Forbes Wheels